Irs 2024 Schedule 2 – By law, the IRS must wait until at least mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments . If you run a small business, particularly one that has employees and offers benefits such as a workplace retirement plan, then recent tax changes could affect you this tax filing season. For You: .

Irs 2024 Schedule 2

Source : www.fox21news.comIRS Tax Refund Calendar 2024: Check expected date to get return

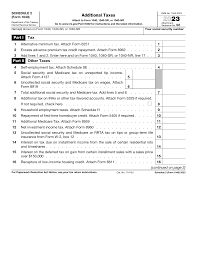

Source : ncblpc.org2023 Form IRS 1040 Schedule 2 Fill Online, Printable, Fillable

Source : schedule-2-form.pdffiller.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

Source : www.bscnursing2022.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaIRS Deposit Schedule 2024 Check the Tax Refund Release Date

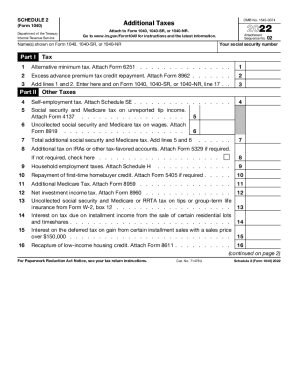

Source : ncblpc.orgIRS 1040 Schedule 2 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comFederal Tax Filing Deadlines for 2024 420 CPA

Source : 420cpa.comIRS Tax Refund Delay Update 2024 Payout Schedule and Status

Source : www.reddit.com2024 IRS Tax Refund Calendar Estimate When You Will Get Your Tax

Source : www.cpapracticeadvisor.comIrs 2024 Schedule 2 IRS Releases Updated Schedule 2 Tax Form and Instructions for 2023 : During the 2024 tax season, the IRS said it’s adding staff and technology to “reverse the historic low audit rates” on high-income taxpayers. Filing season can already be a stressful time for many, . Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The .

]]>