Irs Form 2024 Schedule E 2024 – Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. The . There’s still a couple of months left to file your taxes this year. But if you can’t make the deadline, you can file a free tax extension. .

Irs Form 2024 Schedule E 2024

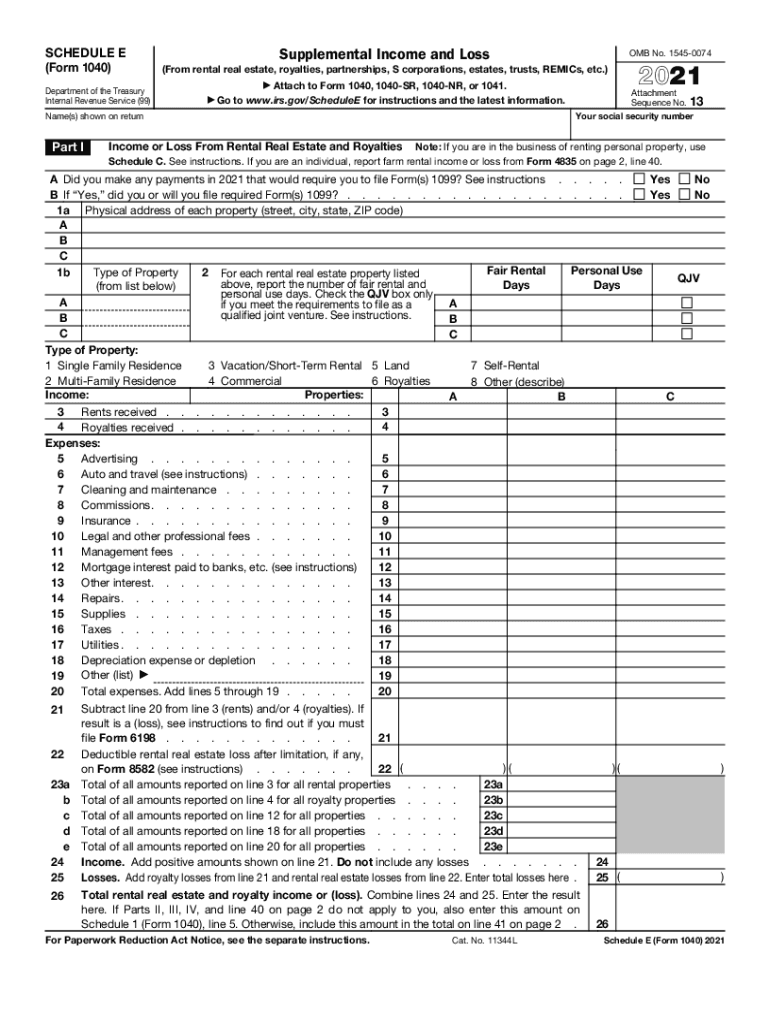

Source : www.therealestatecpa.com2023 Form IRS 1040 Schedule E Fill Online, Printable, Fillable

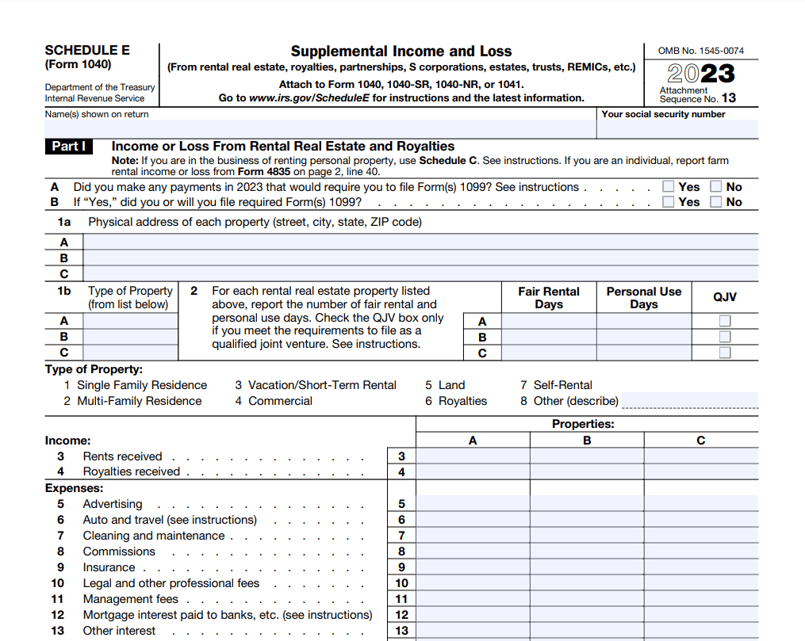

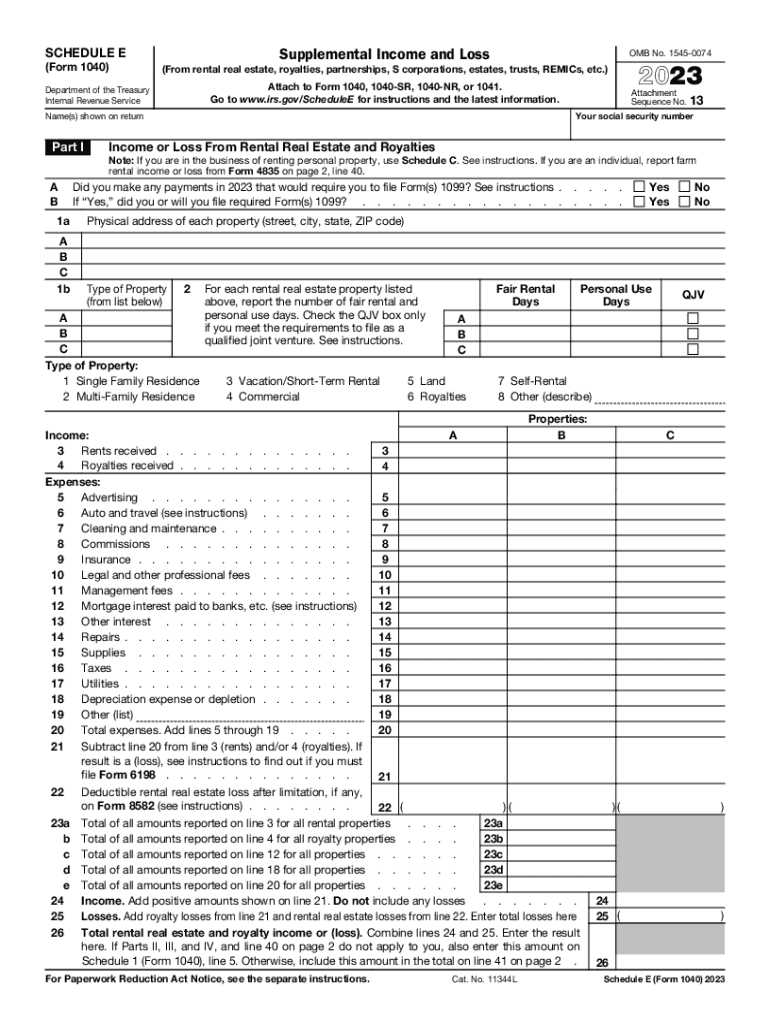

Source : irs-form-schedule-e.pdffiller.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comWhen To Expect My Tax Refund? IRS Refund Calendar 2024

Source : thecollegeinvestor.comIRS 1040 Schedule E 2022 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comIRS 1040 Schedule E 2003 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.comSchedule e: Fill out & sign online | DocHub

Source : www.dochub.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comIrs Form 2024 Schedule E 2024 The 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors: The due date is approaching and it is once again time to file your tax returns. Filing taxes for 2023 can feel overwhelming, but with the right guidance, you can determine how to navigate . The IRS finally made it through a backlog of tax returns caused by COVID 19-related delays. The agency had a backlog of about 17 million paper-filed Form 1040 tax returns at the close of the 2021 .

]]>